Last night the Government announced the Federal Budget including these proposed changes and initiatives:

$250 economic support payments:

Two tax-free economic support payments of $250 each will be paid to individuals in receipt of certain government income support and health care card holders including the:

• Age Pension

• Disability Support Pension

• Carer Payment

• Carer Allowance

• Family Tax Benefit

• Double orphan pension

• Commonwealth Seniors Health Card

• Pensioner Concession Card

• Eligible Veterans’ Affairs payment recipients and concession card holders.

Payments will be made from November 2020 and early 2021.

Bringing-forward income tax cuts:

From 1 July 2020, the low income tax offset (LITO) and the thresholds for the 19% and 32.5% personal income tax brackets are proposed to increase. This means the tax cuts legislated to occur from 1 July 2022 (Stage 2 of the Government’s Personal Income Tax Plan) will commence two years early.

Stage 3 of the Personal Income Tax Plan remains unchanged and commences in 2024/25 as legislated.

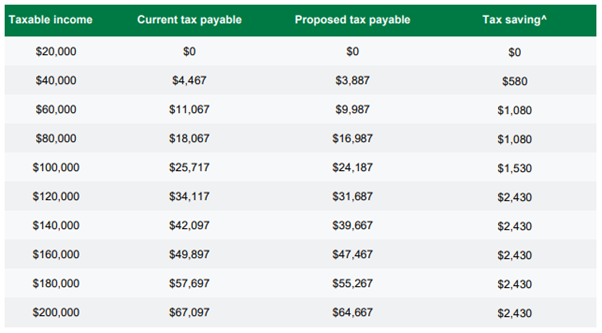

The amount of the tax savings:

The proposed bring-forward of the personal income tax thresholds, rates and tax offsets create the following future tax savings.

Please read the Federal Budget Summary to find out how these proposed budget changes may affect your financial situation.

We hope you find this information useful. If you would like to discuss the announcements and the possible implications in relation to your financial strategy, please contact me on 08 8172 9111 with any questions.