If you’re not eligible for a Pension Concession Card, don’t worry. The Commonwealth Seniors Health Card supports eligible Australians of pension age to access cheaper health care, medications and services. Financial Adviser and Superannuation expert, Christina Tran outlines this CSHC card in more detail including the benefits and eligibility requirements.

The Commonwealth Seniors Health Card (CSHC) can provide retirees with discounted health costs and various concessions from the Government. You can claim a CSHC once you’re Age Pension age.

Benefits available for CSHC holders are:

- Access to medicines listed on the Pharmaceutical Benefits Scheme (PBS) at the concessional rate ($6.60 maximum). Once they reach the PBS safety net ($316.80), their medicine will be free for the remainder of the year

- Lower concessional Extended Medicare Safety Net threshold for out-of-hospital medical expenses

- Bulk billed doctor visits (doctors receive higher Medicare payments if they treat a CSHC holder, so some practices may bulk bill CSHC holders)

- Discounts for stamps and mail direction from Australia Post

- State and Territory Government concessions which vary between each state

To qualify for the CSHC, an individual needs to meet certain age, residency and income requirements. The CSHC is valid for 12 months and is reissued on 1 August each year provided the CSHC holder continues to meet the eligibility criteria.

Eligibility criteria for the CSHC:

A person must meet the following eligibility criteria to qualify for the CSHC:

- Have reached pension age for Centrelink or Department of Veterans Affairs (DVA) (age 65-67)

- Be an Australian citizen or a holder of a permanent visa

- Be in Australia on the day the claim is lodged for the CSHC

- Not be receiving an income support payment or service pension from Centrelink or DVA

- Meet the requirements of the income test

On 1 January 2017, there were changes to the assets test taper rate and thresholds for Centrelink and DVA. Age Pensioners who lost their entitlement as a result of the changes were automatically issued with the CSHC without the income test requirement.

Income test requirements

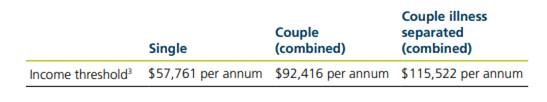

To qualify for the CSHC, a person’s Adjusted Taxable Income (taxable income + super contributions + investment losses + foreign income + fringe benefits over $1,000) plus deemed income from your financial assets must be less than the income thresholds below:

The income threshold is increased by $639.60 for each dependent child in the person’s care.

Centrelink will require a copy of your latest tax notice of assessment to determine your adjusted taxable income and calculate your eligibility.

Account-based income streams:

From 1 January 2015, all account-based income streams are now deemed for the CSHC income test unless the grandfathering provisions apply. The balance of a person’s account-based income streams will be deemed and added to their Adjusted Taxable Income.

The current deeming rates are:

If you’re single

The first $53,600 of your financial assets has the deemed rate of 0.25% applied. Anything over $53,600 is deemed to earn 2.25%.

If you’re a member of a couple and at least one of you get a pension

The first $89,000 of your combined financial assets has the deemed rate of 0.25% applied. Anything over $89,000 is deemed to earn 2.25%.

If you’re a member of a couple and neither of you gets a pension

The first $44,500 of each of your own and your share of joint financial assets have a deemed income of 0.25% per year. Anything over $44,500 is deemed to earn 2.25%.

The deeming rates are adjusted every year to ensure they keep up with current market conditions.

If you have any further questions or need assistance with your Centrelink entitlements, please let us know.